Not known Facts About Whole Farm Revenue Protection

Wiki Article

7 Easy Facts About Whole Farm Revenue Protection Shown

Table of ContentsWhole Farm Revenue Protection Can Be Fun For EveryoneWhat Does Whole Farm Revenue Protection Do?The Definitive Guide to Whole Farm Revenue ProtectionThe 6-Minute Rule for Whole Farm Revenue ProtectionThe 4-Minute Rule for Whole Farm Revenue ProtectionGetting The Whole Farm Revenue Protection To WorkExamine This Report about Whole Farm Revenue Protection

Ranch as well as cattle ranch residential property insurance coverage covers the possessions of your ranch and cattle ranch, such as animals, tools, buildings, setups, and also others. These are the typical insurance coverages you can obtain from ranch and ranch residential property insurance policy.Your farm and also ranch makes use of flatbed trailers, confined trailers, or energy trailers to haul items and also tools. Commercial auto insurance will certainly cover the trailer yet just if it's affixed to the insured tractor or vehicle. Therefore, if something occurs to the trailer while it's not attached, then you're left on your own.

Workers' compensation insurance coverage offers the funds an employee can utilize to buy drugs for an occupational injury or disease, as suggested by the medical professional. Employees' settlement insurance covers rehabilitation.

The 9-Minute Rule for Whole Farm Revenue Protection

You can insure yourself with workers' compensation insurance. While acquiring the policy, providers will offer you the liberty to consist of or omit on your own as a guaranteed.

Rumored Buzz on Whole Farm Revenue Protection

Several ranch insurance coverage providers will also provide to compose a farmer's automobile insurance. In some scenarios, a farm insurance coverage provider will just offer certain types of auto insurance coverage or only insure the automobile risks that have procedures within a certain scope or scale.

Whatever carrier is writing the farmer's vehicle insurance coverage, heavy and also extra-heavy vehicles will need to be put on a industrial car policy. Trucks labelled to a business farm entity, such as an LLC or INC, will need to be positioned on a business policy no matter the insurance policy provider.

If a farmer has a semi that is used for hauling their very own ranch products, they may be able to include this on the very same industrial automobile policy that insures their commercially-owned pick-up vehicles. Nonetheless, if the semi is utilized in the off-season to transport the products of others, many basic ranch as well as commercial auto insurance carriers will certainly not have an "appetite" for this kind of risk.

Whole Farm Revenue Protection Things To Know Before You Buy

A trucking plan is still a business car plan. Nonetheless, the carriers who supply insurance coverage for operations with vehicles utilized to carry items for 3rd events are generally specialized in this kind of insurance coverage. These sorts of operations develop higher risks for insurance firms, larger claim volumes, and a better extent of claims.An experienced independent agent can help you understand the sort of policy with which your business automobile must be guaranteed as well as discuss the nuanced implications as well as visit this web-site insurance policy effects of having several vehicle plans with numerous insurance coverage service providers. Some vehicles that are made use of on the ranch are insured on personal automobile plans.

Commercial cars that are not qualified for an individual vehicle plan, however are used specifically in the farming procedures supply a lowered threat to insurance provider than their business use counterparts. Some service providers decide to guarantee them on a farm auto policy, which will have slightly various underwriting requirements and rating frameworks than a normal commercial auto plan.

Some Known Factual Statements About Whole Farm Revenue Protection

Many farmers delegate older or restricted usage automobiles to this kind of registration because it is an affordable means to keep an automobile being used without every one of the additional costs typically related to automobiles. The Department of Transportation in the state of Pennsylvania categorizes numerous different sorts of unlicensed ranch vehicles Kind A, B, C, as well as D.Time of day of usage, miles from the residence farm, and also other constraints use to these sorts of cars. So, it's not a good suggestion to entrust your "daily vehicle driver" as an unlicensed farm automobile. As you can see, there are numerous kinds of ranch vehicle insurance plan readily available to farmers.

Whole Farm Revenue Protection Fundamentals Explained

It's important to review your automobiles as well as their usage freely with your agent when they are structuring your insurance profile. This type of in-depth, conversational technique to the insurance coverage buying process will certainly aid to guarantee that Related Site all insurance coverage voids are closed and you are getting the best worth from your informative post plans.Disclaimer: Details and claims offered in this material are implied for helpful, illustratory purposes and also ought to not be taken into consideration legitimately binding.

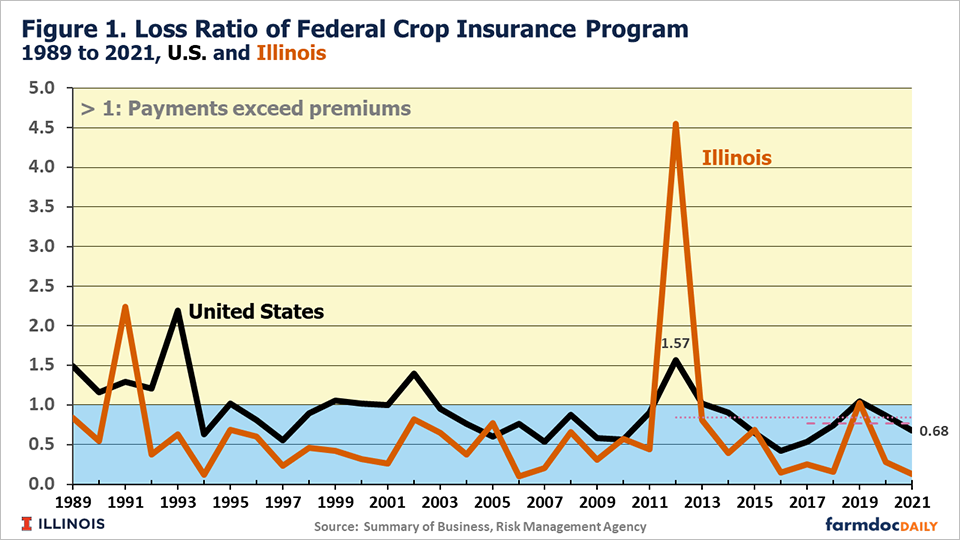

Plant hail storm protection is marketed by private insurance firms as well as managed by the state insurance coverage divisions. There is a government program providing a selection of multi-peril crop insurance coverage items.

The 3-Minute Rule for Whole Farm Revenue Protection

Unlike various other kinds of insurance coverage, plant insurance policy hinges on well established dates that apply to all policies. These dates are established by the RMA in advance of the planting period and published on its site. Dates vary by plant and also by region. These are the crucial dates farmers must anticipate to satisfy: All crop insurance applications for the assigned area and crop are due by this date.Report this wiki page